Cyber risk insurance Tailor-made solutions for your digital risks

Get a quick and accurate assessment of your cyber posture. Identify your vulnerabilities, receive concrete recommendations, and improve your insurability in just a few clicks.

Don't let cybercriminals target your business.

Our cyber risk expertise and customized insurance solutions turn your weaknesses into security assets.

Don't leave your digital future to chance. In the ever-evolving cyberspace, the best defence is a proactive one. That's where our insurance solutions come in. Secure your digital future with us.

Cyberattacks are no longer a distant threat; they’re already targeting local SMEs.

We’ve developed a cyber insurance program designed specifically for small and professional businesses: Cyber posture assessment included, Coverage tailored to your reality, Human and personalized support.

Are you insurable against cyber threats?

👉 Find out your insurability level and protect your business today!

The 5 key elements of a cyber risk insurance policy

These elements cover the essential aspects of a comprehensive cyber risk insurance policy, offering both reactive and proactive protection against digital threats.

- Protection against data breaches

- Coverage for ransomware attacks

- Compensation for business interruption losses

- Data/system recovery and restoration costs

- Protection against third-party claims

- Coverage of legal defense costs

- Compensation for regulatory fines and penalties (if insurable)

- Access to cybersecurity and forensic experts

- Coverage of notification costs for affected customers

- Public relations and reputation management services

- Coverage of losses due to cybercrime (e.g. electronic fraud)

- Compensation for loss of income due to cyber incidents

- Coverage of additional costs to maintain operations

- Risk assessments and security audits

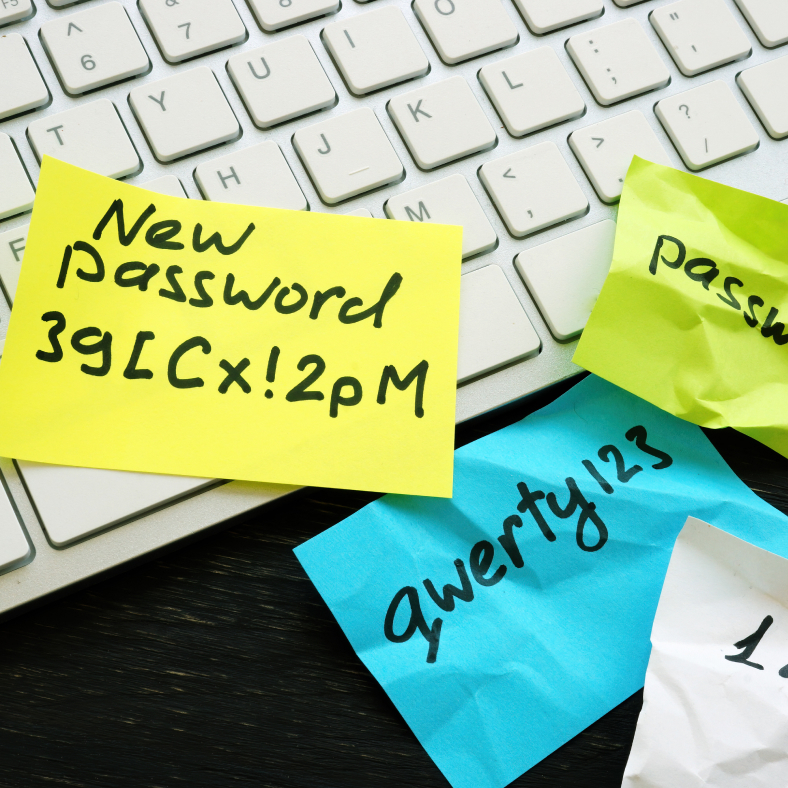

- Cybersecurity training for employees

- Post-incident technical support and security improvements

In the cyber world, the best defence is a proactive, scalable strategy.

Protect your digital future today !

The long-term impact is particularly worrying. Around 60% of Canadian SMEs that suffer a major cyber attack cease trading within six months of the incident. The main reasons are the astronomical costs associated with the attack and the loss of customer confidence.

Cyber insurance typically covers costs related to data breaches, business interruptions caused by cyber attacks, ransomware extortion, customer notification costs, legal fees and reputational damage. It can also include coverage for financial losses due to cybercrime.

No, company size is not a determining factor. Small and medium-sized businesses are often prime targets for cybercriminals, as they generally need more resources dedicated to cybersecurity. A cyber attack can devastate a small business, so adequate protection is essential.

You can reduce your premiums by implementing robust security measures, such as up-to-date firewalls, intrusion detection systems, regular employee cybersecurity training, strong password policies, and regular backups. These measures demonstrate to the insurer that you take cybersecurity seriously.

Yes, most cyber insurance policies cover incidents caused by employee error, such as clicking on a phishing link or losing an electronic device containing sensitive data. However, employees' intentional malicious acts are generally excluded.

Professional liability insurance generally covers errors and omissions in providing professional services, whereas cyber insurance focuses specifically on data and computer systems risks. Cyber insurance offers specialized coverages such as crisis management in the event of a data breach, which are not included in standard professional liability policies.

It's an approach to IT security that trusts nothing and nobody by default, whether inside or outside the corporate network.

Zero Trust Policy is a security model based on the premise that nothing and no one should automatically be considered trustworthy, whether inside or outside the corporate network. Its main aspects are as follows:

- Constant verification : Every access, user, or device is checked every time, even if already authorized.

- Least privilege : Users have access only to those resources strictly necessary for their work.

- Micro-segmentation : The network is divided into small zones to limit movement in the event of a breach.

- Multi-factor authentication : Use of several methods to confirm user identity.

- Continuous monitoring : Real-time analysis of all network behaviour.

- Generalized encryption : All data is encrypted, whether in motion or at rest.

- Context-based access policy : Authorizations depend on location, device used, or time of day.

This comprehensive approach helps prevent security breaches by not relying on default elements, thus strengthening the company's overall protection against internal and external cyber threats. The Zero Trust policy's comprehensive nature should instill a sense of security in the audience.